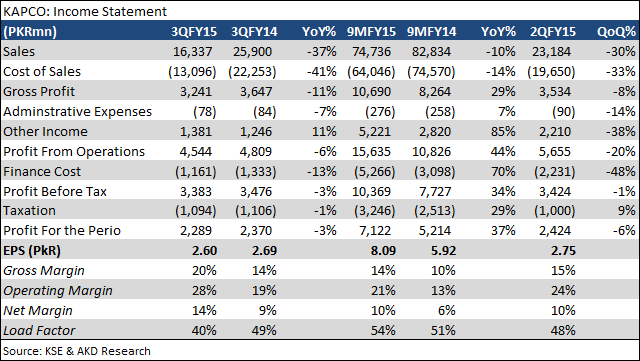

KAPCO has released its 3QFY15 results posting profit after tax of Rs2.29 billion (EPS: Rs2.6/share) remaining mute at -3%YoY clip. The 37% fall in sales and relatively larger 41%YoY dip in cost of sales (led by depressed fuel costs) aided gross margins to rise to 20% from 14% for 3QFY14.

KAPCO has released its 3QFY15 results posting profit after tax of Rs2.29 billion (EPS: Rs2.6/share) remaining mute at -3%YoY clip. The 37% fall in sales and relatively larger 41%YoY dip in cost of sales (led by depressed fuel costs) aided gross margins to rise to 20% from 14% for 3QFY14.

Important takeaway are: 1) a 11%YoY increase in other income to Rs1.38 billion on the back of penal income, 2) finance costs at Rs1.16 billion dipping by 13%YoY as a result of controlled short term borrowing and tapering rates.

During 9MFY15 KAPCO reported net profit of Rs7.12 billion (EPS: R8.1/share), a sturdy 37%YoY increase, in the absence of major overhauls and improving liquidity dynamics (penal interest payments keep other income higher by 85%YoY).

As expected, margin improvements characterized results, with the present dip in furnace oil prices (41% decline FYTD) and HSD (24% decline FYTD) allowing for improved gross margins. Net margins were assisted by falling finance costs and buoyed other income. Subdued load factors continued with the latest generation data by CPPA pointing to a relatively low load factor hovering near 40%, with the 250MW block 3 of the plant remaining unutilized.